To Know the Major difference between a primary market and a secondary market, first understand what is a capital market.

The primary market and secondary market both are parts of the capital market. The capital market is the market which deals in financial instruments such as bonds, equities etc.

So, firstly let’s understand about what is a Primary Market :

Primary Market & its Features

Primary market refers to the market in which securities like equity, shares, debentures, and bonds are issued for the first time to the public. The primary market is also called New Issue Market (NIM). With the help of the primary market, new companies or already established companies collect capital so that they can expand their business.

Methods of Raising Capital in the Primary Market :

1) Public Issue:-

In a public issue, the company prepares a prospectus and issues it so that it can collect capital from the public. The objective of the issue written in that prospectus. The investor who likes the prospectus of the company can invest in that company.

2) Offer for sale:-

In Offer for Sale, the company sells its new securities to an intermediary (stockbroker). After this, the intermediary later sells the security to the public. The company does not face many headaches in this type of issue.

3) Right issue:-

This method is mostly used by those companies whose securities are already listed in the market. And later, when that company issues any new security, it will first invite its exciting shareholders.

4) Private Placement:-

In this method, the company sells its securities to any institutional investor or their selected individuals only. A private placement is regarded as an economical means of issuing securities. If a company cannot afford public issue or other methods, then those companies mostly adopt private placement.

5) IPO (Initial Public Offering) :-

IPO is a new trend in issuing securities. To issue an IPO, the company has to enter into a contract with a stock exchange. Then a SEBI registered broker is appointed to accept the application of that company. Along with this, the selected broker keeps sending all the details to the company.

Features of Primary Market:-

1) Only New Securities are Issued:-

The first feature of the primary market is that only new securities are issued in it.

2) The price of Securities is decided by Management:-

Whenever securities are issued for the first time, then its price is decided by the management of the company. While deciding the price of a security, the management decides keeping in mind the future growth and fundamentals of the company.

3) Flexibility:-

In the primary market, the company has the flexibility to issue its security by choosing any method.

Secondary Market & its Features

When securities of a company are issued for the first time, they are in the primary market. Then later buying and selling of other securities keeps happening. Then later buying and selling of those securities keep happening. There is no limit on the number of times, a security will be bought or sold in the market. We can buy and sell any security in the market unlimited times. The secondary market is regulated by the stock exchange.

Features of Secondary Market

1) It has a Particular Place:-

The secondary market has a particular place which is a stock exchange. The secondary market is regulated by the stock exchange itself.

2) Liquidity:-

Liquidity means immediate conversion of securities into cash. Liquidity is the best Feature of the secondary market. If an investor needs immediate cash, he can sell his security.

3) No Price Control:-

The company cannot control the price of its securities in the secondary market. The price of any security is based on its demand and supply.

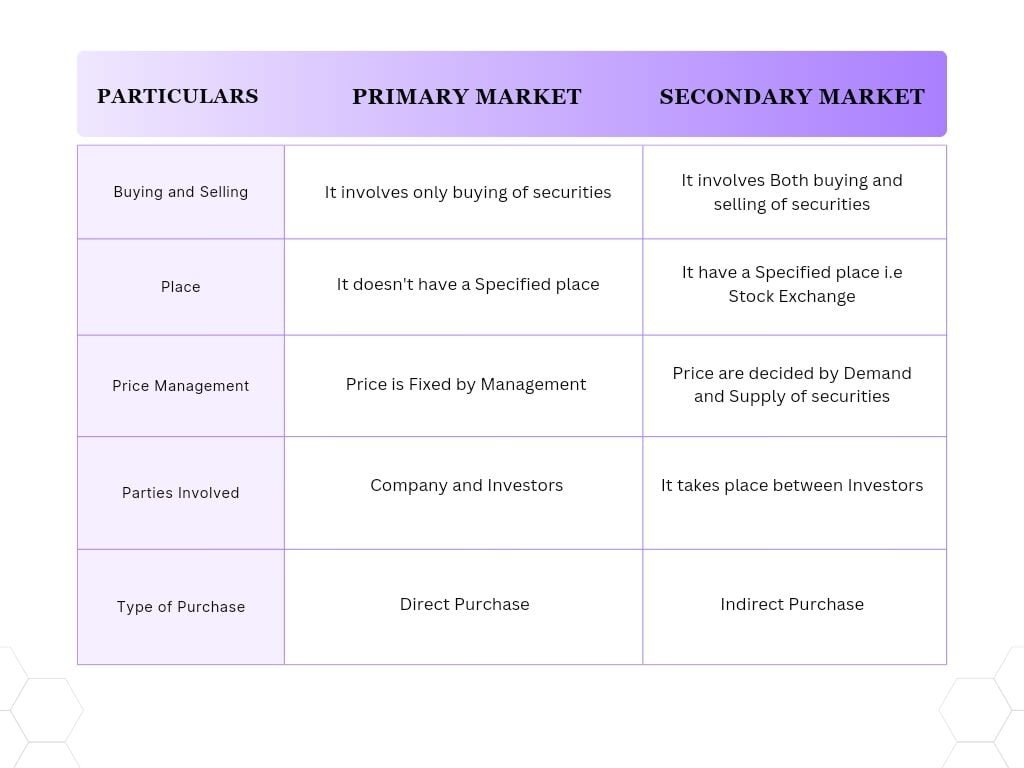

Differences Between Primary & Secondary Market :

These are the Major difference between Primary Market & Secondary Market

ALSO READ: Top 10 Mutual Funds for Long term growth