With the help of a personal loan, your credit history is not only built, but you also do not need any collateral security to take a personal loan. If you want quick loan approval, then you need to have a better financial record. However, there are some platforms which provide you loans even without income proof but their interest charges are high. When your savings are sufficient then a loan helps you to get out of that dilemma. While taking a loan, you also have to keep in mind that you should have the resources to repay it.

Here are the 8 Best Instant Personal Loan Apps for Self Employed :

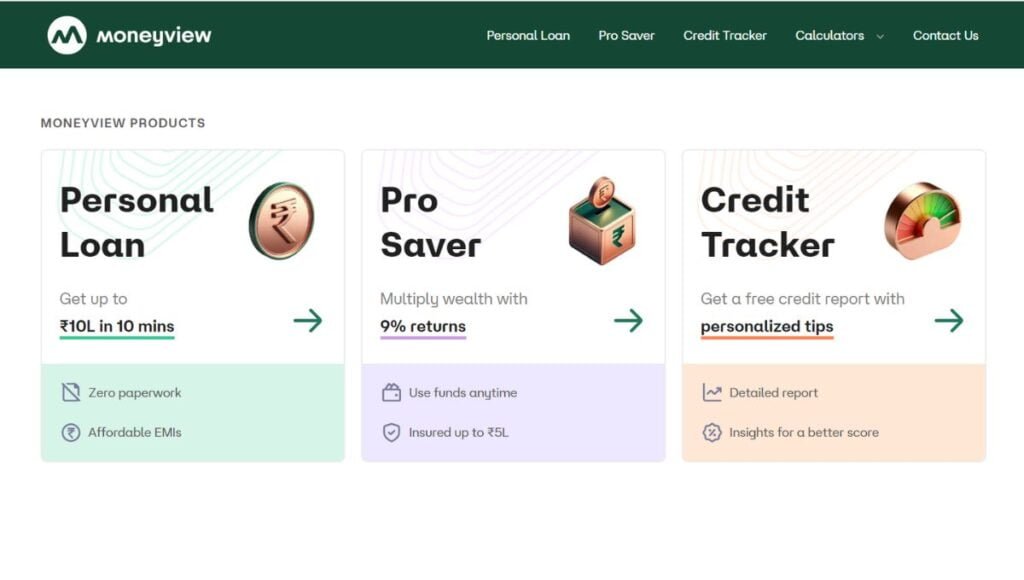

1) Moneyview

Money View is a digital platform licensed by the Reserve Bank of India. Money View is a very popular platform for instant loans. Money View has more than 45 million app downloads and distributed more than Rs 12000 Cr+ loans. Punit Aggarwal is the CEO of Money View. Money View offers loan amounts between Rs. 5,000 to Rs. 5,00,000.

Services offered by Moneyview :

- Instant Personal Loans

- Pro saver account

- Credit Tracker

Moneyview: Interest Rates & Charges

| Details | Fees & Charges |

| Interest Rate | 1.33% per month |

| Loan Processing Charges | 2% of loan amount |

| NACH Bounce | Rs.500/- each time |

| Penal charges on Overdue EMI | 24% per annum + applicable taxes, if any |

Foreclosure Time

- Loan Tenure Up to 6 Months – Not allowed

- Loan Tenure Between 7-18 Months – Allowed after 6 EMI Payments

- Loan Tenure over 18 Months – Allowed after 12 EMI Payments

Eligibility Criteria

- AGE:- 21 to 57 years

- CIBIL Score:- 650+

- Minimum Monthly Income:- Rs 13,500 for Salaried Persons and Rs 15,000 for Self Employed.

Required Documents

- PAN Card

- Mobile Number (linked with your aadhaar card)

Moneyview: Lending Partners

- Whizdm Finance Pvt Ltd

- Aditya Birla Pvt Ltd

- DMI Finance Pvt Ltd

- Clix Capital Services Pvt Ltd

- Kisetsu Saison Finance Pvt Ltd

- SMFG India Credit Company Ltd

- Incred Financial Services Pvt Ltd

- Northern Arc Capital Ltd

- Suryodaya Small Finance Bank

- IDFC First Bank

2) MoneyTap

MoneyTap is an RBI (Reserve Bank of India) approved and instant loan provider platform. MoneyTap provides you instant loans up to ₹500000. They have more than 5 lakh customers and have been providing service for 7 years. MoneyTap has disbursed loans of Rs 10,000 Cr+. MoneyTap is 100% safe and secure. They Provide you quick online support.

MoneyTap: Interest Rates & Charges

| Details | Fees & Charges |

| Interest Rate | 1.08% per month |

| Loan Processing Charges | Rs 3,000 to Rs 5,000 :- Rs 199 + GST Rs 5,000 to Rs 10,000:- Rs 399 + GST Rs 10,000 to Rs 25,000:- Rs 499 + GST Rs 25,000 and Above:- Rs 2% of total amount + GST |

| Late Payment Penalty | Rs 500 |

| Pre-payment Penalty | 3% of pre-payment amount |

Eligibility Criteria

- AGE:- 23 to 55 years

- Minimum Monthly Income:- Rs 30,000

- Must be a resident of one of the following cities:-

- Ahmedabad

- Anand

- Bangalore

- Chennai

- Chandigarh

- Coimbatore

- Delhi

- Gandhinagar

- Hyderabad

- Indore

- Jaipur

- Mumbai

- Mohali

- NCR

- Panchkula

- Pune

- Rajkot

- Secunderabad

- Surat

- Vadodara

- Vijayawada

- Vizag

Required Documents

- PAN Card Number

- Selfie

- Address Proof

- Valid Driving License / Valid Passport / Aadhar Card

- ID Proof

- Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / PAN card

MoneyTap: Lending Partners

- Kisetsu Saison Finance Pvt Ltd

- SMFG India Credit

- Incred Financial Services Pvt Ltd

- RBL Bank

- TapStart

- Apollo Finvest India Ltd

- Cholamandalam Finance

- Lendbox

3) KreditBee

KreditBee targets this platform to become the first choice of people for personal loans. Credit Bee is a platform where you can take a loan ranging from Rs 1,000 to Rs 5,00,000. KreditBee is specially created for self-employed and salaried professionals. Credit Bee has over 90 million app downloads and low interest rates.

Services Offered by KreditBee

- Business Loan

- Flexi Personal Loan

- Personal Loan for Self-Employed

- Personal Loan for Salaried

KreditBee: Interest Rates & Charges

| Details | Fees & Charges |

| Interest Rate | 1) Flexi Personal Loans: Rs 85 – Rs 1,250 2) Personal Loans for Salaried (for loan amount from Rs 10,000 to Rs 2 lakh): Up to 6% of the loan amount (minimum Rs 500) |

| Loan Processing Charges | 1) Flexi Personal Loans: Rs 85 – Rs 1,250 2) Personal Loans for Salaried (for loan amount from Rs 10,000 to Rs 2 lakh) : Up to 6% of the loan amount (minimum Rs 500) |

| Penalty Charges for Auto Debit | Rs 100 |

Eligibility Criteria

- AGE:- 21 to 60 years

- Minimum Monthly Income:- Rs 10,000

Required Documents

- Selfie

- Identity Proof (PAN)

- Address Proof

- Aadhaar Card

- Passport

KreditBee: Lending Partners

- Krazybee Services Pvt Ltd

- Incred Financial Services Ltd

- Vivriti Capital Ltd

- Northern Arc Capital Ltd

- MAS Financial Services Ltd

- PayU Finance India Pvt Ltd

- Poonawalla Fincorp Ltd

- Kisetsu Saison Finance Pvt Ltd

- Piramal Capital & Housing Finance Ltd

- Cholamandalam Investment and Finance Company Ltd

- Mirae Asset Financial Services Pvt Ltd

- Tata Capital Ltd

4) Navi

Navi provides Instant personal loans up to Rs 20 lakh. Navi provides instant loans with 100% paperless process. Navi has more than 3 crore app downloads with 11 lakhs+ active loans and more than Rs 16,900 crore loan amount disbursed. Navi is one of the best instant personal loan apps for self-employed

Services Offered by Navi

- Mutual Fund

- Home Loan

- Health Insurance

- Cash Loan

- Personal Loan

Navi: Interest Rate & Charges

| Details | Fees & Charges |

| Interest Rate | 9.9% to 45% per annum |

| Loan Amount | Up to Rs 20 Lakhs |

| Repayment Tenure | 72 Months |

| Loan Processing Charges | 3.99% to 6% of the loan amount |

| Foreclosure Charges | 0 |

Eligibility Criteria

- AGE:- 21 to 65 years

- CIBIL Score:- 750+

- Monthly Income:- More than Rs 25,000

Required Documents

- Aadhaar Card

- Pan Card

Navi: Co-Lending Partners

- Piramal Capital & Housing Finance Ltd

- Cholamandalam Investment and Finance Company Ltd

- Aditya Birla Pvt Ltd

- Tata Capital Ltd

- Kisetsu Saison Finance Pvt Ltd

- Transactree Technologies Pvt Ltd

5) mPokket

mPokket is a flexible and hassle-free instant personal loan provider, in just 10 minutes loan approval process. With a rating of 4.4 stars on Play Store, they have more than 24 million app downloads and 18 million+ happy users. mPokket was founded in 2016 by Gaurav Jalan and their headquarter is in Kolkata. They provide Loans up to Rs. 45,000.

Services Offered by mpokket

- Loan for College Students

- Loan for Working Professionals

- Loan for Self-Employed

mpokket: Interest Rate & Charges

| Details | Fees & Charges |

| Interest Rate | 2.00% per month |

| Repayment Tenure | Up to 120 days |

| Processing Fees | Rs. 50 to Rs. 200 plus 18% GST |

| Loan Extension Charges | 1% of the loan amount |

| Late Payment Penalty | 0.6% of the amount due |

Eligibility Criteria

- AGE:- 18 to 60 years

- Minimum Monthly Income:- Rs 9,000

- Mobile Number (linked with your aadhaar card)

Required Documents

- Proof of Identity

- Aadhaar card/ PAN card/ Voter ID card/ Driving license/ Passport

- Proof of Address

- Bank statement/ Electricity bill

- Proof of Income

- Bank statement for the last 3 months

mpokket: Lead Partners

- Buddy Loan

- Bajaj Markets

- ZET

- Moneyfy

- Quid

Also Read: Best Zero Balance Savings Account for Students

6) CASHe

CASHe provides loans ranging from ₹1000 to ₹4 lakh for a tenure of up to 1.5 years. They call themselves, Bharat Ka Money App. CASHe was founded by V. Raman Kumar.

Services Offered by CASHe

- Instant Personal Loan

- Education Loan

- Car Loan

- Medical Loan

- Marriage Loan

- Travel Loan

- Two Wheeler Loan

- Insurance

CASHe: Interest Rate & Charges

| Details | Fees & Charges |

| Interest Rate | 2.25% per month onwards |

| Repayment Tenure | 90 – 540 days |

| Processing fee | Up to 3% of the loan amount |

| Late Payment Penalty | 0.7% |

Loan Eligibility and Disbursal Limits

| Tenure | Loan Eligibility |

| 90 days | Up to 110% of net monthly salary |

| 180 days | Up to 210% of net monthly salary |

| 270 days | Up to 310% of net monthly salary |

| 360 days | Up to 400% of net monthly salary |

| 540 days | Up to 500% of net monthly salary |

Eligibility Criteria

- AGE:- 23 to 58 years

- Minimum Monthly Income:- Rs 15,000

- Employment:- Salaried

Required Documents

- Latest Salary Slip

- PAN card for photo ID proof

- Aadhaar card

- Proof of Address

- Passport/ Driver’s license/ Utility bill showing your name/ Voter ID card

- The latest bank account statement shows the salary credited into the account.

CASHe: Lending Partners

- Vivriti Capital Ltd

- Home First

- Northern ARC

- Apollo Finvest Ltd

- Transactree Technologies Pvt Ltd

7) PaySense

PaySense stands for making all things finance more simple, accessible and transparent. PaySense was founded in 2015. They Provide instant personal loans from ₹5000 to ₹5 lakh to fit all your needs and dreams. If you have never taken a personal loan before then PaySense provides you loan with zero credit history. PaySense provides you loans from ₹5,000 to ₹5,00,000 with flexible EMI options.

Services Offered by PaySense

- Instant Personal Loan

- Salaried Loan

- Self Employed Loan

- Car Loan

- Two Wheeler Loan

- Travel Loan

- Consumer Loan

PaySense: Interest Rate & Charges

| Details | Fees & Charges |

| Interest rate | 1.4% to 2.3% per month |

| Processing Fees | Up to 2.5% of the loan amount |

| Late Payment Penalty | Rs 500 + GST |

| Foreclosure Charges | 4% |

Eligibility Criteria

- AGE:- 21 to 60 years

- Minimum Monthly Income

- Rs 12,000 for Salaried

- Rs 15,000 for Self Employed

Required Documents

- Proof of Identity

- PAN Card & Selfie

- Proof of Address

- Aadhaar card, Voter ID, Passport or Driving License

- Proof of Income

- Last 3 months’ bank e-statements

PaySense: Partnership

- PayU Finance India Private Limited

- IDFC First Bank

- Kisetsu Saison Finance Pvt Ltd

- SMFG India Credit Company Ltd

8) Buddy Loan

Buddy Loan is the leading fintech innovation facilitating loan services provider. They are recognised with one of the highest approval rates in the industry. Buddy Loan is an RBI-approved Service provider. Buddy Loan was Founded in 2019 by Srikanth Bureddy and Satish Saraf. Buddy Loan app has more than 20 Cr+ Downloads. They provide loans starting from Rs 10,000 to Rs 15 Lakhs for repayment tenure up to 6 months to 5 years. Buddy Loan is also one of the best instant personal loan apps for self-employed

Services Offered by Buddy Loan

- Personal Loan

- Business Loan

- Two wheeler Loan

- Car Loan

- Marriage Loan

- Travel Loan

- Medical Loan

- Education Loan

- Gold Loan

Buddy Loan: Interest Rate & Charges

| Details | Fees & Charges |

| Interest Rate | 11.99% per annum onwards |

| Processing Fees | 0.5% to 4% of the loan amount |

| Prepayment Charges | 2% to 5% of the loan amount |

| Foreclosure Charges | 2% to 4% of outstanding principal |

Eligibility Criteria

| Criteria | Salaried | Self Employed |

| Age | 21 to 60 years | 22 to 55 years |

| Monthly Income | Rs 15,000 | Rs 25,000 |

| CIBIL Score | 750+ | 750+ |

| Loan Amount | Rs 50,000 to Rs 25 lakhs | Rs 50,000 to Rs 50 lakhs |

Required Documents

- Proof of Identity

- Passport/ Voter ID/ Driving License/ PAN Card

- Proof of Address

- Passport or Utility Bills

- Proof of Income

- For Salaried Employee: Bank statement of salary account for the past 2 years

- For Self-Employed: Audited Financial for the past 2 years