The Annasaheb Patil Economic Development Corporation (APEDC) introduced the Annasaheb Patil Loan scheme in 2024. The objective of Annasaheb Patil Loan Scheme is to give a boost to individuals, particularly young people who are unemployed and those who are facing financial difficulties.

In Maharashtra, there are many people who aspire to become entrepreneurs but struggle due to financial constraints. To address this issue, the Maharashtra government initiated the Annasaheb Patil loan scheme. If you opt for a loan under this scheme to start your business, you will have a repayment period of up to 5 years.

Remember, only permanent residents of Maharashtra are eligible for this loan scheme. You can get a loan between Rs 10 lakhs and Rs 50 lakhs through the Annasaheb Patil Loan Scheme. The more this scheme is put into action, the lower the unemployment rate will be. This is because the funds borrowed through annasaheb patil loan scheme will be used to start new businesses or expand existing ones.

When individuals start or expand their businesses, it will result in more job opportunities. As employment opportunities increase, people will achieve greater financial independence. For a country to develop, it is necessary to have a strong business sector. The more businesses a country has, the more it will progress.

Types of Loans in Annasaheb Patil Loan Scheme

- Personal Loan Interest Repayment Plan

- Group Loan Interest Repayment Scheme

- Group Project Loan Scheme

Also Read: Bhabishyat Credit Card Scheme

Benefits of Annasaheb Patil Loan Scheme

It’s time to discover the benefits of this scheme that distinguish it from other loan schemes in Maharashtra:

- You can get a loan from Rs 10 lakh to Rs 50 lakh without any interest.

- This scheme is to assist individuals, who are unemployed and those struggling financially.

- Borrowers are given a 5-year timeframe to settle the loan.

- This scheme will decrease the unemployment rate in Maharashtra.

Eligibility Criteria for Annasaheb Patil Loan

- The applicant needs to be a resident of Maharashtra.

- It’s required for the applicant to have a bank account, and it would be best if it’s a current account rather than a savings account.

- The age limit for male applicants is 50 years.

- The maximum age for female applicants is 55 years.

Required Documents for Annasaheb Patil Loan

- Proof of Identity: Aadhaar Card, PAN Card, Driving License, Passport, Voter’s ID Card.

- Proof of Address: Utility Bills, Passport, Voter’s ID Card, Driving License.

- Proof of Age: Aadhaar Card, PAN Card.

- Proof of Income: Salary Slip, Balance Sheet, and Profit & Loss account for the past 2 years, along with the latest ITR and income computation that has been CA Certified/Audited.

- Additional Documents:

- Bank statement for the previous 6 months.

- Caste Certificate.

- Business-project report.

Annasaheb Patil Loan: Application Process

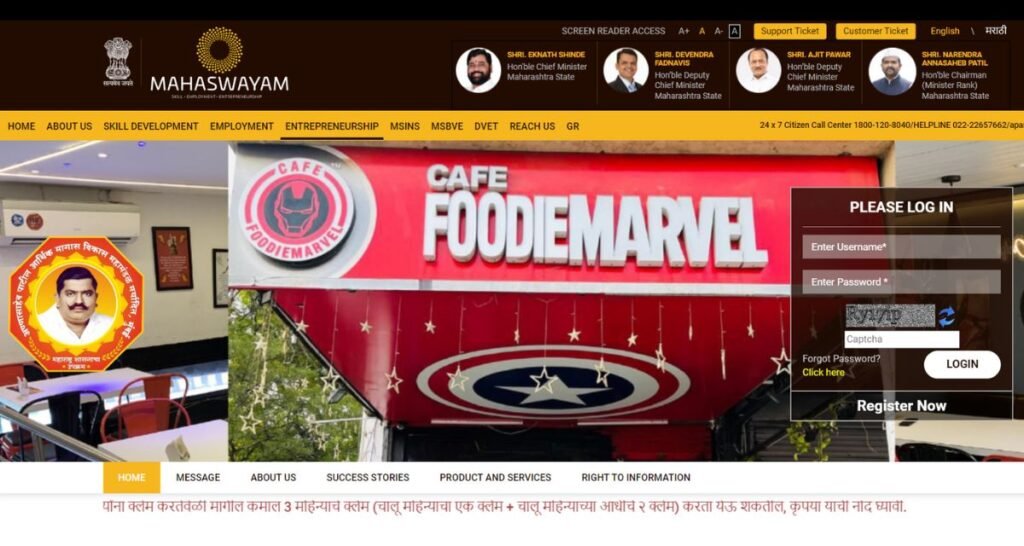

Step 1: To apply for the Annasaheb Patil loan, you need to visit the official website.

Step 2: Click on the register now option to begin the application process.

Step 3: After registering successfully, fill out the application form.

Step 4: Complete the application form accurately to avoid rejection.

Step 5: Click on the “next” option after filling out the form.

Step 6: Enter the OTP sent to your registered mobile number to submit your application for the loan scheme.

Once you submit the application, it will be reviewed by the authorities. If it gets approved, the loan amount will be directly transferred to your bank account.

FAQs

Who is eligible for the Annasaheb Patil Loan Scheme?

Living in Maharashtra, having a bank account, and being under 50 years old for males or under 55 years old for females makes you eligible for the Annasaheb Patil loan scheme.

What are the benefits of the Annasaheb Patil Loan?

You can avail a loan from Rs 10 lakh to Rs 50 lakh without any interest with a 5-year timeframe to settle the loan.

Which documents are required for the Annasaheb Patil Loan Scheme?

Aadhaar Card, PAN Card, Utility Bills, Salary Slip/ Balance Sheet, Profit & Loss account for the past 2 years, Bank statement for the previous 6 months, Caste Certificate and Business-project report.

Do I need to provide any security to get this loan?

You don’t need to provide any collateral for this loan.

Is it possible to apply for multiple loans under this scheme?

It is not allowed to apply for multiple loans under this scheme.