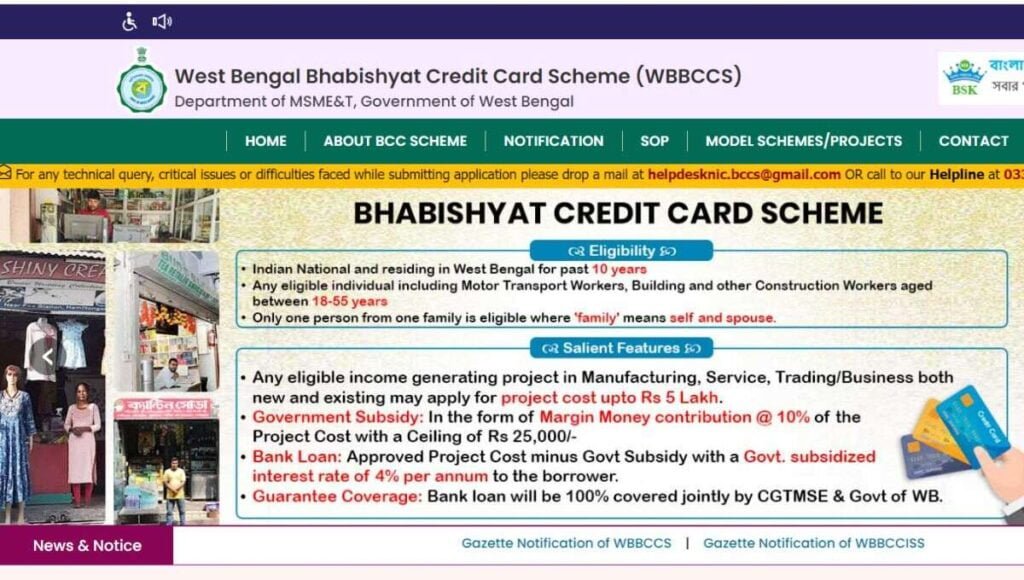

The Bhabishyat credit card scheme was introduced by the West Bengal Government on April 1, 2023. Young entrepreneurs aged 18-55 can benefit from the Bhabishyat credit card scheme. This scheme provides subsidy-linked loans without the requirement of collateral. The Department of Micro, Small and Medium Enterprises and Textiles West Bengal oversees the scheme.

The Bhabishyat credit card scheme was introduced by the West Bengal Government on April 1, 2023. Young entrepreneurs aged 18-55 can benefit from the Bhabishyat credit card scheme. This scheme provides subsidy-linked loans without the requirement of collateral.

These loans can be used to establish micro-enterprises in manufacturing, services, trading, or agriculture. If you’re a resident of West Bengal with a solid business plan, you can take advantage of the Bhabishyat credit card scheme.

This program was created by the government of West Bengal for people who want to start businesses but don’t have the funds. You might be thinking that you need a guarantor to get a loan under this scheme, but with the Bhabishyat credit card, you can get a loan without any collateral because the government will be your guarantor.

Eligible borrowers can receive coverage from both CGTMSE and the State Government. CGTMSE offers up to 85% coverage, while the State Government provides a maximum coverage of 15%. Today, we are going to share all the details about the Bhabishyat Credit Card Scheme in West Bengal and show you the steps to apply for a loan under this scheme.

Features of the Bhabishyat Credit Card Scheme

- The scheme aims to inspire entrepreneurs to take advantage of financial support under WBBCCS.

- This scheme is for young entrepreneurs who are between 18 and 55 years old.

- The bank loan will be completely secured by CGTMSE and the West Bengal Government.

- You need to contribute 10% of the Project Cost as Margin Money, capped at Rs 25,000.

- The borrower will receive the approved project cost after deducting the government subsidy, with a subsidized interest rate of 4% per annum.

- You can apply for a Term loan and/or working capital loan/composite loan whether you have a new unit or an existing unit.

- Projects that can generate income in Manufacturing, Service, Trading/Business, whether they’re new or already in operation, are eligible to apply for project costs up to Rs 5 Lakh.

Bhabishyat Credit Card Scheme: Eligibility Criteria

- Only Indian citizens are eligible to apply.

- If you’ve been living in West Bengal for 10 years or more, then you are eligible for this scheme.

- Motor Transport Workers, Building and other Construction Workers, and other eligible individuals aged 18-55 can apply.

- Only one person per family is eligible, that includes yourself and your spouse.

Also Read: 8 Best Instant Personal Loan Apps for Self-Employed

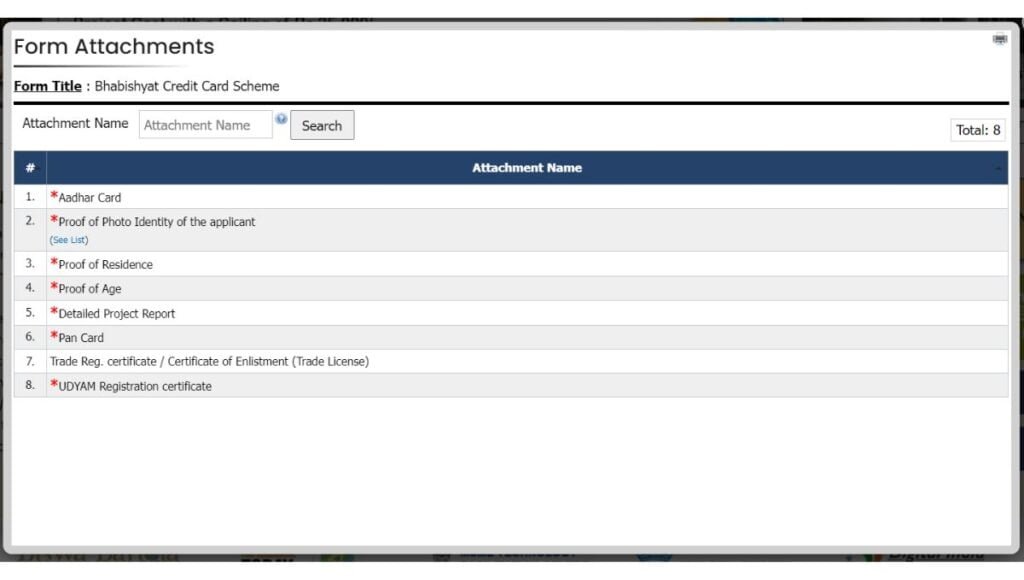

Bhabishyat Credit Card Scheme: Required Documents

- Proof of Residence

- Proof of Age

- Aadhar Card

- PAN Card

- UDYAM Registration certificate

- Detailed Project Report

- Passport Size Photo

Requirements of Image File:

- Photo – Keep the file size between 20 KB and 100 KB.

- Resolution – The file should have a minimum resolution of 350 pixels (Width) X 350 pixels (Height).

- Signature – Make sure the dimensions are 200 x 230 pixels. Keep the file size between 20 KB and 50 KB.

Bhabishyat Credit Card Scheme: Non-applicability

- Borrower who has defaulted on a loan from a Bank/ Financial Institution.

- Government Undertakings employees and their families are not eligible for the Scheme.

Online Application Process for the Bhabishyat Credit Card Scheme:

- Visit the official website of West Bengal Bhabishyat Credit Card Scheme.

- Now, you have to register as a New User and then use the correct login details to submit the form online.

- Once you’ve registered on the Bhabishyat Credit Card Scheme’s official portal, you need to select the “apply now” option.

- Fill in all the required details as stated in the online form.

- Attach the required documents along with the application form.

- Next, send in your application for review.

- The MSME&T department will review your application.

- Further updates will be sent to your registered mobile number and email ID.

FAQs

What is the target coverage for the Bhabishyat credit card scheme?

The target coverage of Bhabishyat credit card scheme is to cover 2,00,000 young individuals in a year.

Who is eligible to apply for the Bhabishyat Credit Card?

1) Indian citizen living in West Bengal for the last 10 years.

2) Motor Transport Workers, Building and other Construction Workers, and other eligible individuals aged 18-55 can apply.

What’s the interest rate on the Bhabishyat Credit Card?

The annual interest rate is 4%.

What is the primary objective of the Bhabishyat Credit Card Scheme?

The primary objective is to empower the youth to start their own businesses, which will result in making money, building wealth, and generating more job opportunities in rural and urban areas of the State.

Do I need to submit any fees for online registration?

There is no need to submit any fees for online registration.

How can I see if my application has been reviewed?

After logging in, you’ll see a link labelled “Details” on the Dashboard. Click on it to view the status of your application after submitting the online form.

Is there a cap on the annual income for the Bhabishyat Credit Card Scheme?

No, the family’s annual income is not capped.

Can a user apply for multiple applications using the same login credentials on this portal?

It’s not possible to submit multiple applications using the same login on this portal.